Breaking Down the Cost of Health Insurance with UnitedHealth Group

Breaking Down the Cost of Health Insurance with UnitedHealth Group

Understanding Health Insurance Costs

What is health insurance?

Health insurance is a contract between an individual and an insurance provider, such as UnitedHealth Group, that helps cover medical expenses. It is designed to protect you from high healthcare costs by paying for medically necessary services and treatments.

Why are health insurance costs important?

Understanding health insurance costs can help you budget for healthcare expenses and make informed decisions about the coverage that best suits your needs. Knowing the factors that contribute to these costs can help you estimate your out-of-pocket expenses and choose the right plan.

Factors that Affect Health Insurance Costs

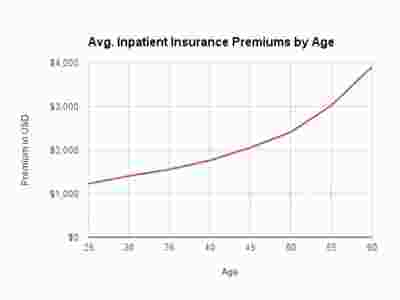

Age and Gender

Your age and gender can influence the cost of health insurance. Generally, older individuals and women have higher premiums due to higher healthcare usage and risks associated with certain conditions.

Location

Health insurance costs can vary based on where you live. Urban areas usually have higher healthcare costs, leading to higher premiums compared to rural areas.

Plan Type

Different types of health insurance plans, such as Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO), have varying costs. HMOs typically have lower premiums but require referrals, while PPOs offer more flexibility but may have higher costs.

Covered Services

The extent of coverage for specific services can affect the cost of health insurance. Plans with broader coverage for services like prescription drugs, specialist visits, or mental health care may have higher premiums.

The Costs of Health Insurance with UnitedHealth Group

Premiums

Premiums are the monthly payments you make to the insurance company to maintain coverage. With UnitedHealth Group, premium amounts vary depending on the specific plan you choose, your age, location, and other factors mentioned earlier.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. UnitedHealth Group offers plans with different deductible options, allowing you to choose what works best for your budget.

Copayments and Coinsurance

Copayments are fixed amounts you pay for specific services, such as doctor visits or prescription medications. Coinsurance, on the other hand, is a percentage of the cost you pay for covered services after you’ve met your deductible. UnitedHealth Group’s plans offer various copayment and coinsurance options to suit your needs.

Frequently Asked Questions

Q: Can I estimate my health insurance costs with UnitedHealth Group before purchasing a plan?

A: Yes, UnitedHealth Group provides online tools and resources that allow you to estimate premiums, deductibles, and out-of-pocket costs based on your specific needs and preferences.

Q: Does UnitedHealth Group offer financial assistance or subsidies for health insurance?

A: UnitedHealth Group offers Affordable Care Act (ACA) compliant plans that may qualify for government financial assistance, based on your income and household size. These subsidies help lower your monthly premiums and out-of-pocket costs.

Q: Can I change my UnitedHealth Group plan if my health insurance needs change?

A: Yes, UnitedHealth Group typically offers open enrollment periods during which you can change your plan. Additionally, certain life events, such as getting married or having a baby, qualify for a special enrollment period, allowing you to make changes outside of the regular enrollment period.

Conclusion

Understanding the cost breakdown of health insurance is essential for making informed decisions about your coverage with UnitedHealth Group. Factors like age, location, plan type, and covered services can affect the cost of premiums, deductibles, copayments, and coinsurance. By carefully evaluating these factors and utilizing UnitedHealth Group’s resources, you can select a health insurance plan that suits your needs and budget. Remember to review your options annually during open enrollment to adapt to any changes in your healthcare requirements.